Amata Releases Statement to Committee on American Samoan Small Businesses

Washington, D.C. – Wednesday, Congresswoman Aumua Amata released prepared remarks to the Small Business Committee regarding small business tax reform and American Samoa's employers.

"It's a privilege to raise awareness in Congress about American Samoa's local economy and the circumstances of our small businesses," Aumua Amata said. "My Statement to the Small Business Committee highlights a specific way in which the tax code treats small businesses in American Samoa differently, and how that could be a disadvantage to growth."

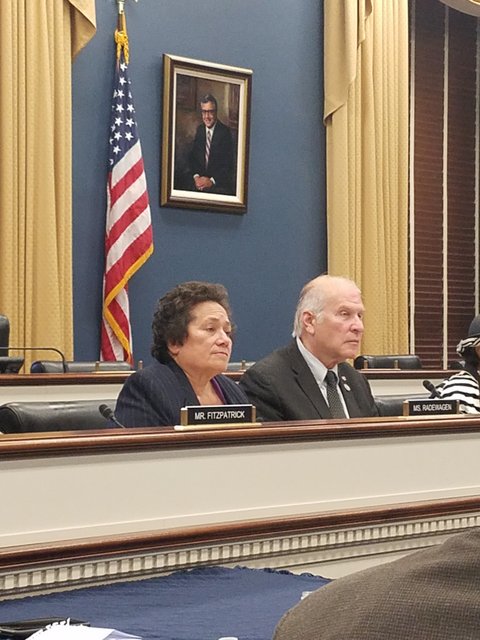

Congresswoman Amata with Chairman Chabot of Colorado recently.

"Right now, tax reform is a major topic in Congress, and my priority is to see that upcoming changes in the tax code are made with an understanding of American Samoa's economic realities," Congresswoman Amata continued. "This hearing is an important topic, and I will continue my outreach to other Members of Congress to ensure they understand the impact of reforms on American Samoa."

Today's hearing was titled, "Small Business Tax Reform: Modernizing the Code for the Nation's Job Creators." The Congresswoman's full Statement to the Committee on Small Business is below:

Talofa, Good Morning. I want to thank the Chairman and Ranking Member for holding this important meeting on tax reform.

Over 95% of businesses located in my home of American Samoa are small businesses. On top of all the other issues that small business in American Samoa faces is that the IRS treats businesses incorporated in the territories as foreign companies – which creates a perverse incentive that to discourages territorial small businesses from expanding to the mainland.

All five territories are facing severe crises – from natural disasters to economic collapse. Growth of small businesses can ensure sustainability and reduce the volatility of the territories.

My hope is that we can work together to promote small business growth in the territories – and encourage a change to the tax code that would incentivize and not deter small business growth in American Samoa, CNMI, Guam, Puerto Rico, and the USVI.

###